Value Added Tax (VAT) is a mandatory consumption tax in the UAE, and achieving compliance requires detailed attention at every stage of your supply chain. KWS offers Comprehensive VAT Support services to ensure end-to-end management of all your obligations, securing accuracy, maximizing input tax recovery, and minimizing your exposure to penalties.

Value Added Tax (VAT) regulations are constantly evolving, presenting significant compliance challenges and potential financial risks for businesses. Our Comprehensive VAT Support Services are specifically designed to be your complete end-to-end solution.

We help you streamline your tax operations, stay ahead of regulatory changes, and protect your organization from costly penalties and administrative burdens.

By partnering with us, you gain more than just compliance; you gain a strategic advantage. Our experts provide tailored, proactive advice

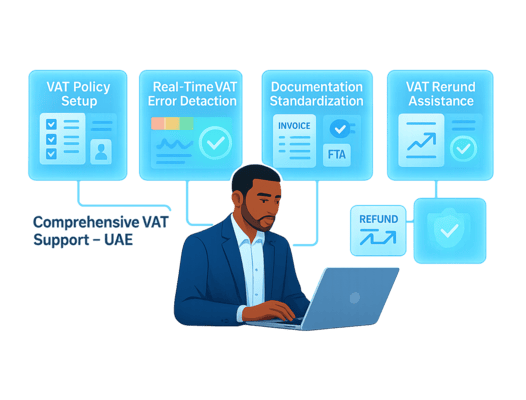

Our firm offers complete support across the entire VAT lifecycle, ensuring your business meets every compliance obligation with accuracy and ease:

Our services are designed to support a wide range of businesses, including: