KWS provides end‑to‑end support for obtaining a Tax Residency Certificate (TRC) in Dubai and across the UAE — ensuring compliance, eligibility validation, and smooth application with the Federal Tax Authority (FTA).

It helps you avoid double taxation, strengthen your global compliance profile, and simplify international financial operations.

Check eligibility in 5 minutes — get a custom TRC readiness checklist. (Optional interactive cue for lead generation)

Start My Tax Residency Certificate

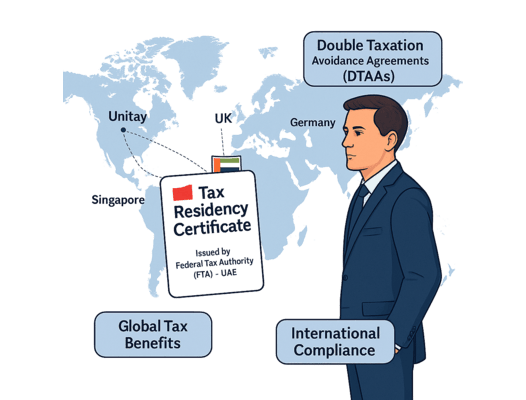

The Tax Residence Certificate (TRC) is an official document issued by the UAE Federal Tax Authority (FTA) to businesses and individuals in the UAE, establishing their tax residency status. This certificate is vital for benefiting from double taxation avoidance agreements (DTAA) between the UAE and various countries.

Whether you’re a business operating in the UAE or an individual residing here, obtaining a TRC certificate can significantly reduce your tax burden by ensuring you are taxed fairly based on your UAE residency.

| Service | Deliverable |

|---|---|

| Eligibility assessment | Review of residency, incorporation, and compliance status |

| Document preparation | Collation of required documents (licenses, tenancy, bank statements, audited accounts) |

| Application filing | Submission to the FTA via online portal |

| Liaison & follow‑up | Communication with FTA until certificate issuance |

| Renewal & validity tracking | Monitoring expiry and re‑application |

| Advisory | Guidance on treaty benefits and compliance obligations |

Timelines vary depending on applicant type (individual vs. company), completeness of documents, and FTA approval cycles.

Typically 3–4 weeks, including preparation and FTA review.

It is not mandatory for all, but essential to claim treaty benefits and avoid double taxation.

Yes — provided they meet substance and operational requirements.

Usually valid for one year from issuance.

It allows UAE residents and companies to claim treaty benefits, preventing taxation in both UAE and foreign jurisdictions.

FAQs

KWS offers a comprehensive suite of services, including accounting, payroll processing, tax preparation, financial advisory, and global payroll solutions.

It is an official document issued by the FTA confirming an individual’s or company’s tax domicile in the UAE.

UAE residents (minimum 183 days stay), companies incorporated in the UAE, and eligible freezone entities.

Applications are filed online with the FTA, supported by tenancy contracts, utility bills, bank statements, and audited accounts.

Trade license, incorporation certificate, tenancy contract, utility bills, bank statements, audited financials, passport copies, and Emirates ID.

Fees vary by applicant type; individuals start from AED 2,000, companies from AED 10,000.

Effortlessly handle Tax Residency Certificate with KWS’s expert services.

Tax Residency Certificate in UAE

Free eligibility scan before submission

No hidden fees

Starts From

Get a fast eligibility check and a clear, costed path to file Form 211.