It’s the official process of registering your business with the FTA for UAE Corporate Tax compliance.

KWS offers a fast, compliant, and fully managed corporate tax registration service for businesses across Dubai and the UAE — including EmaraTax setup, document preparation, and post-registration support.

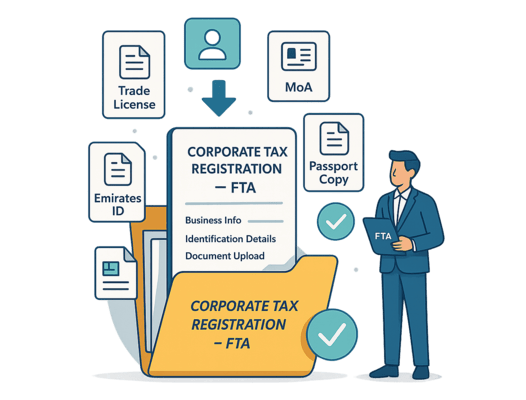

Corporate Tax (CT) - is a federal direct tax levied on the net profits of corporations and other businesses. Corporate tax registration is the **mandatory process** by which a business formally enrolls with the **Federal Tax Authority (FTA)** via the EmaraTax portal to obtain its Tax Registration Number (TRN).

The purpose of registration is to ensure full compliance with tax laws, enabling the business to fulfill its obligations, file tax returns, and pay taxes on its profits. The system is designed to be highly competitive, offering a **0% tax rate on taxable income up to AED 375,000** and a standard 9% rate on income exceeding that threshold.

Note : Even if your business qualifies for 0% tax (e.g., small business relief or free zone incentives), registration is still mandatory.

| What We Do | Why It Matters |

|---|---|

| Assess registration eligibility and deadlines | Ensures timely compliance and avoids penalties |

| Prepare and validate required documents | Reduces risk of rejection or delays |

| Complete EmaraTax registration and profile setup | Official FTA portal for corporate tax |

| Submit registration and track status | Ensures confirmation and follow-up |

| Provide post-registration guidance | Helps you prepare for filing and compliance |

Urgency motivator : FTA has active automated monitoring — missing your window leads to fixed penalties.

KWS handles this entire process for you — or guides your team step-by-step.

| Document | Purpose |

|---|---|

| Trade licence and MOA | Confirms legal identity and activity scope |

| Emirates ID and passport of owners | Verifies authorised signatories |

| Financial statements or trial balance | Supports economic substance and eligibility |

| Lease agreement or utility bill | Confirms business location |

| Additional documents (if free zone or foreign entity) | Validates exemption or special status |

FAQs

KWS offers a comprehensive suite of services, including accounting, payroll processing, tax preparation, financial advisory, and global payroll solutions.

It’s the process of registering your business with the FTA to comply with the UAE’s corporate tax regime.

You must log in to your EmaraTax account, complete the registration form, and upload required documents. KWS can handle this for you.

It depends on your license issue date and financial year. Most businesses must register within 3–6 months of their first tax period.

Yes — registration is mandatory even if you expect to benefit from a 0% rate.

The FTA may impose a fixed penalty of AED 10,000 for late registration.

Yes — KWS is authorised to register your business and manage the process end-to-end.

You can log into EmaraTax and view your application status. We also track and notify you once approved.

Effortlessly handle Corporate Tax Registration with KWS’s expert services.

1 . Free consultation before engagement

2 . No hidden fees

Corporate Tax Registration

The Most Affordable Registration Fee in the Industry!

Starts From

1 . Avoid penalties..

2 . Stay compliant..

3 . Let KWS handle your corporate tax registration from start to finish.