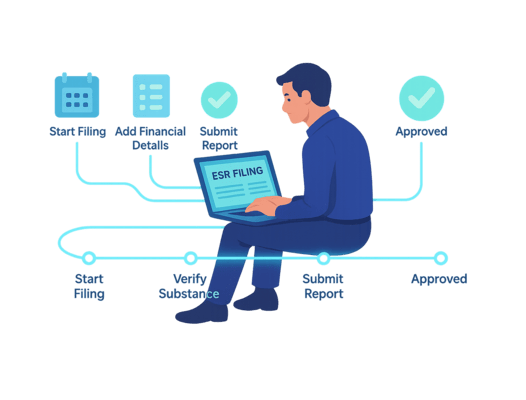

KWS provides complete support for ESR Filing in Dubai and across the UAE — the mandatory annual submission of the Economic Substance Report to the Ministry of Finance and Federal Tax Authority (FTA).

This filing confirms whether your entity has met the Economic Substance Regulations (ESR) requirements after submitting the ESR Notification. Timely ESR Filing helps you avoid penalties, maintain compliance credibility, and demonstrate operational substance in the UAE.

Running a UAE Business with Relevant Activities? Then ESR Filing Is a Must.

If your company is involved in banking, insurance, lease-financing, holding companies, or IP-related work, you need to comply with ESR filing requirements. These rules ensure your business has a real presence and operates genuinely within the UAE—not just on paper.

| Service | Deliverable |

|---|---|

| ESR assessment | Determine if you need Notification only, or also Filing |

| Eligibility confirmation | Confirm if your entity must file ESR based on Relevant Activities and income |

| ESR report preparation | Drafting and compiling the Economic Substance Report |

| Documentation support | Collation of licenses, audited financials, operational substance proof |

| ESR filing submission | Filing the ESR report via the Ministry of Finance portal |

| Advisory | Guidance on ESR requirements, exemptions, and penalties |

| Freezone & mainland support | ESR compliance for both freezone and mainland companies |

| Deadline monitoring | Tracking ESR filing deadlines to avoid penalties |

Example : If your financial year ends on Dec 31, your ESR Filing deadline is Dec 31 of the following year.

Within 12 months of the end of your financial year.

Trade license, incorporation certificate, audited financial statements, operational substance proof, and details of Relevant Activities.

Yes — freezone entities must comply if they perform Relevant Activities and earn income.

Via the Ministry of Finance’s online ESR platform.

Yes — notification is the preliminary step; filing is the detailed report confirming compliance if income was earned.

FAQs

KWS offers a comprehensive suite of services, including accounting, payroll processing, tax preparation, financial advisory, and global payroll solutions.

It is the mandatory submission of the Economic Substance Report confirming compliance with ESR requirements.

Entities engaged in Relevant Activities and earning income from those activities during the financial year.

Through the Ministry of Finance’s ESR portal, supported by documentation and compliance review.

Not for everyone. ESR Filing is mandatory only if your entity performed a Relevant Activity and earned income from that activity during the financial year. If no income was earned, you only need to file the ESR Notification.

Penalties range from AED 10,000 to AED 50,000, plus risk of license suspension and FTA audits.

Effortlessly handle ESR Filing with KWS’s expert services.

ESR Filing in UAE

Free eligibility scan before submission

No hidden fees

Starts From

Book a consultation to validate eligibility and receive a checklist of required documents.